A supplementary/omitted tax notice is a tax bill issued by the Township which reflects any additions or improvements that have been made to your property. For example, owners of newly constructed homes will receive a supplementary tax notice pertaining to the assessed value of their house effective from their occupancy date. The supplementary/omitted tax notice is in addition to what may have been previously billed on the property. This tax notice does not include payments already made to your tax account or future instalments that have been previously billed and are still outstanding.

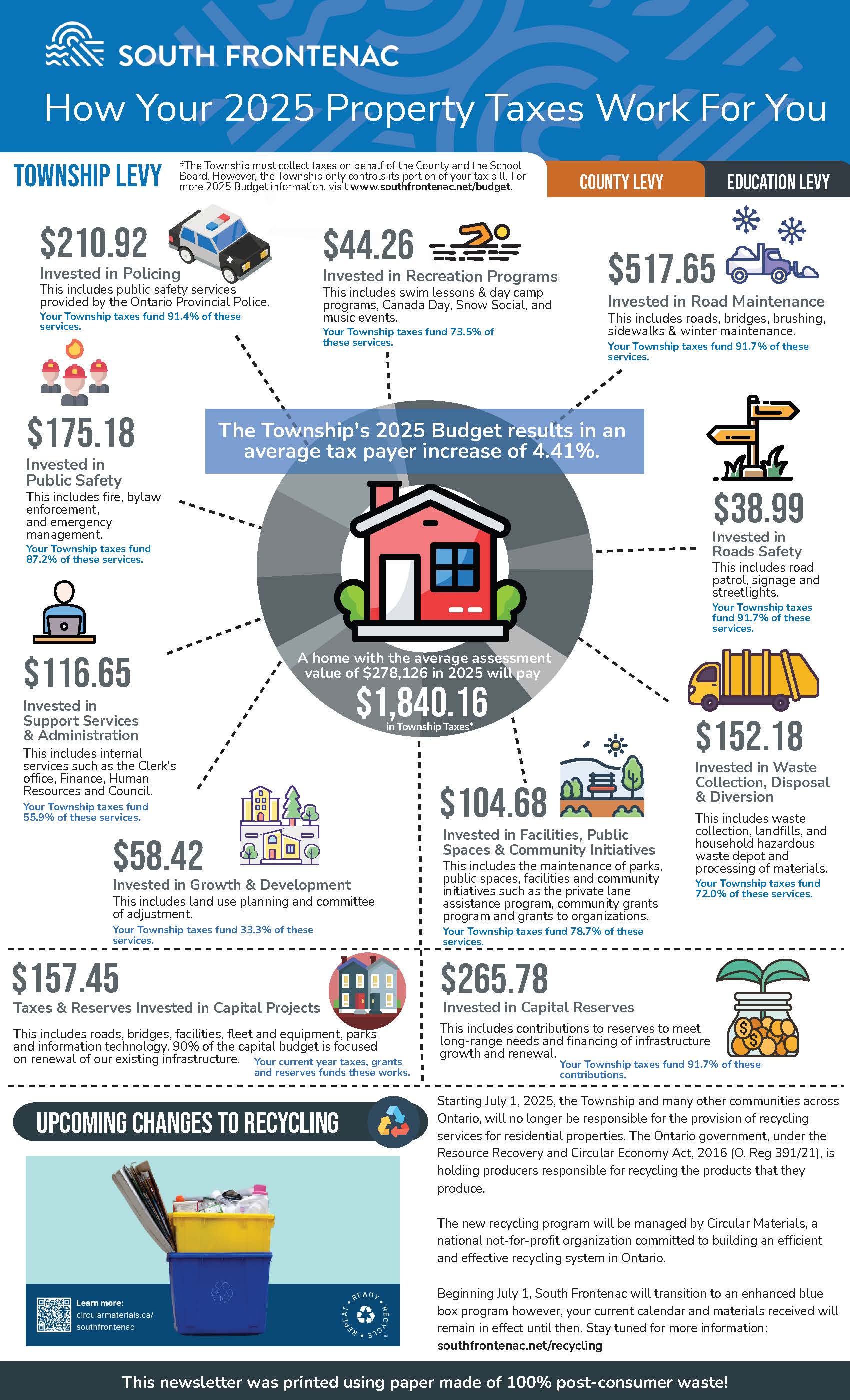

From the assessment information provided by the Municipal Property Assessment Corporation (MPAC), the Township calculates the tax amounts due and issues tax notices, based on the following formula:

Assessment Value X Tax Rate

Number of Days Liable

Legislation allows MPAC to assess a property for the current year and up to two previous years, retroactive to the closing date.

These tax notices are payable in two instalments, as indicated on the due date field of the payment stub.

Reason for Issuing Supplementary/Omitted Bills

You should have already received a Notice of Assessment from MPAC indicating the reason for your supplementary/omitted tax notice(s). A supplementary tax notice can be issued for any of the following reasons:

New Construction

- The value of your new construction was not previously billed to you.

Improvements/Additions to Property

- Renovations/improvements were done to the property that has increased the assessment value and this increase in value was not previously billed to you.

Reclassification

- The entire property or a portion of your property has had a change to the tax class.

If you feel that your supplementary/omitted assessment is incorrect, a Request for Reconsideration (RFR) process is available. Please refer to the Notice of Assessment sent by the Municipal Property Assessment Corporation (MPAC) for the deadline to file an RFR. Please contact MPAC at 1-866-296-6722 or visit http://www.mpac.ca/ for more details.